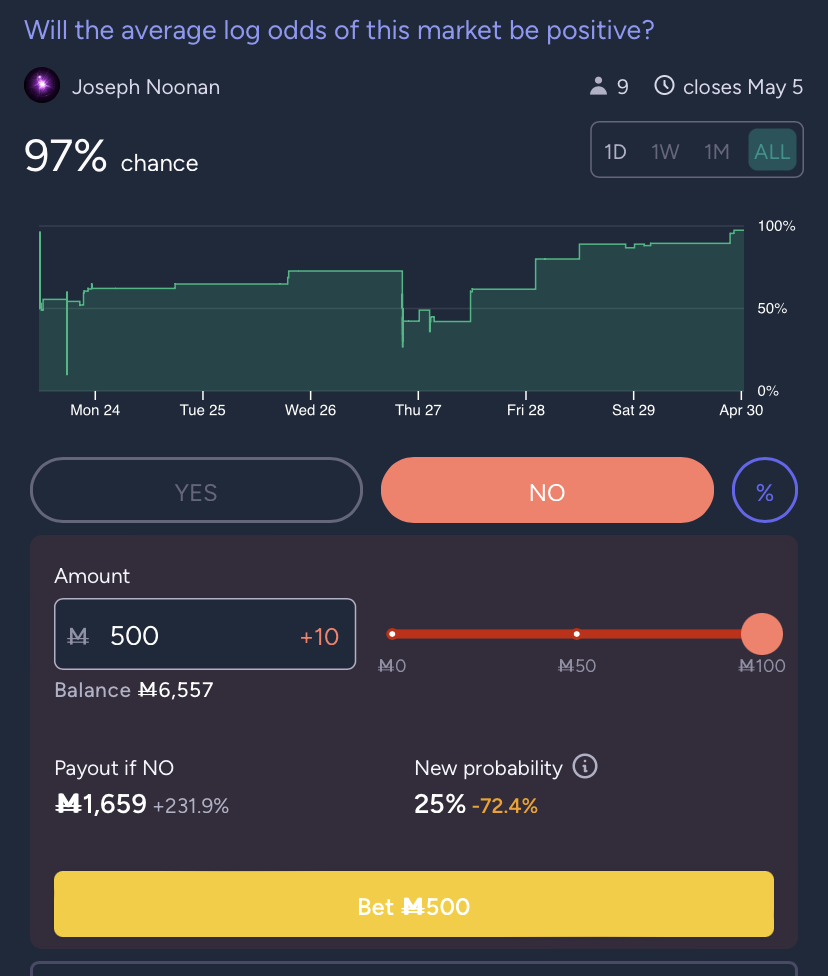

After this market closes, I will calculate the time-weighted arithmetic mean of the log odds of the market, that is, of ln(p/(1-p)), where p is the market's probability. I will use the exact probabilities, not the rounded ones displayed by Manifold.

This is like "The Market", except that it puts higher weight on extreme probabilities, with the weight being proportional to how difficult it is to hold the market at that probability (in terms of the relative price of YES and NO shares). Therefore, it makes it "worth it" to hold the market at such extreme probabilities.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ411 | |

| 2 | Ṁ285 | |

| 3 | Ṁ89 | |

| 4 | Ṁ4 | |

| 5 | Ṁ2 |

@deagol Given that it's based on log-odds, though, the time it spends at the current percentage counts for much more than the time it spent at lower percentages. So the required average could be getting much lower soon.

@levifinkelstein I think it should go into pseudo-random closing to prevent sniping, then resolve when a dogecoin block gets mined with a hashtag ending with “zz”

The log-odds function has maximum curvature at 20.36% and 79.64%, and perhaps passing those would act as tipping points for the average collapsing to zero or 100%? Just throwing ideas out there.

@deagol The market has already gone past both of those points but for such a short time that I don't think it affected the average by much (plus, it spiked in both directions, so they partially cancel each other out). If the whole average went past either of those points, I imagine it would be pretty hard for the other team to recover, though it might actually be slightly easier, given that they can in theory push the odds high/low enough to completely negate the other team's advantage in an arbitrarily small amount of time.

@JosephNoonan yea I’m responsible for both those spikes, just wanted to see the effect on the avg (but risky to hold it longer than a few seconds)

@deagol Did you have to buy through limit orders to cause those spikes, or had none been placed at the time?

I think people here have a YES bias. Turns out the avg of this and the geometric mean (in log form) is neutral at 1/ϕ=ϕ-1 which I like, so that’s where I’ve tried to set it. Makes perfect sense! :)

@deagol I'm a bit confused about why you're trying to set it there. This market doesn't have anything to do with the geometric mean of the probability, only of the odds.

@JosephNoonan c’mon it’s the golden ratio it must mean something! like, the pyramids and sunflowers!

(I’m just messin’ around)

@JosephNoonan people will be subconsciously attracted to this magical ratio, and NO bettors will have a hard time fighting the power of ancient pyramids, the Parthenon, and Fibonacci’s lustful rabbits. You’ll see!

@deagol so Levina @levifinkelstein you seem averse to that magical mirrored-digits one. Ok fine, you prefer The Answer then?

This is equivalent to "Will the geometric mean of the odds of this market be greater than 1?" That makes it a "proper" geometric mean market, as opposed to this one (https://manifold.markets/JosephNoonan/will-the-geometric-mean-of-this-mar), since the geometric mean is actually the proper mean to use for odds, whereas the arithmetic mean is the proper mean for probabilities.