IDEA

A two-sided digital marketplace that directly connects independent, certified ski instructors with skiers seeking personalized instruction and experience-oriented services.

PROBLEM STATEMENT

The European ski instruction market exhibits a pronounced structural misalignment between supply-side organization and demand-side behavior. While demand has become increasingly international, digital, and experience-driven, the industry remains highly fragmented, locally regulated, and operationally analog.

INDUSTRY STRUCTURE

The European ski instruction market is characterized by substantial regional heterogeneity.

Fragmented markets (e.g., Austria, Italy, Germany):

Supply is dominated by a small number of small, locally embedded ski schools, each controlling access to specific resorts or territories.Consolidated markets (e.g., France, Switzerland):

Market power is concentrated in large incumbents such as the École du Ski Français (ESF), which operates more than 220 schools nationwide.

Across all regions, the industry is protected by strong regulatory barriers, including:

Concession-based access on opening ski schools

Lengthy and costly instructor qualification and certification processes

Porter’s Five Forces Assessment

From a structural perspective, the industry is highly attractive for incumbents:

Threat of new entrants: Middle

Regulatory concessions and certification requirements create significant entry barriers. Neverthless a platform model is not restricted by any regulations and can be set up easily.Bargaining power of suppliers (instructors): Low

Instructors are typically dependent on ski schools for access to customers.Bargaining power of buyers (skiers): Low

Customers face limited choice, low transparency, and rigid pricing structures.Threat of substitutes: Low

There are few functional substitutes for formal ski instruction.Competitive rivalry: Low to moderate

Competition is localized and often non-price-based due to territorial constraints.

This structure strongly favors incumbent ski schools. However, it simultaneously creates an opportunity for a platform-based substitute that reconfigures market access, pricing, and value capture without directly competing as a traditional ski school.

INDUSTRY TRENDS

Several structural and demand-side trends are reshaping the industry:

Rising value of the instructor

Customers increasingly seek not only technical instruction but also a personalized, social, and experiential offering. The instructor is perceived as a companion, guide, and local expert rather than a purely functional service provider. I am booking a instructor and not a ski scholl and will also be loyal to him.Digitalization of customer behavior

Online booking, price comparison, reviews, and digital payment have become standard expectations, particularly among international customers.Climate and cost pressures

Shorter ski seasons, declining natural snowfall, and rising reliance on artificial snow increase operating costs. As a consequence, skiing and ski lessons in particular are becoming significantly more expensive, intensifying customer price sensitivity.

These dynamics collectively increase dissatisfaction with rigid, school-centric models while enhancing the appeal of flexible, instructor-centric solutions.

BUSINESS MODEL

Leveraging digital platform economics, the proposed model is a two-sided marketplace that connects independent, certified ski instructors with skiers seeking instruction or guided experiences.

Value Proposition

For Instructors

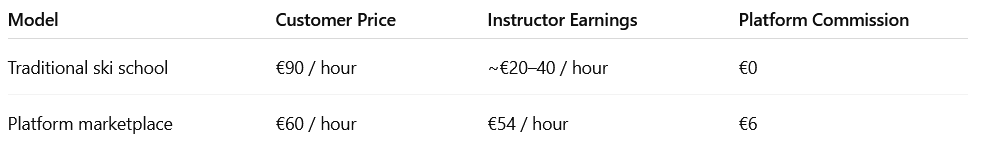

Significantly higher revenue share

Flexible scheduling and pricing autonomy

Direct customer relationships

Reduced dependency on ski schools

For Skiers

Lower prices

Greater transparency

Choice among instructors based on profiles, ratings, and specialization

More personalized offerings

Revenue Model

The platform captures value through a commission-based fee on each completed transaction.

Illustrative Example: Alpe di Siusi

RESOLUTION CRITERIA

Definition of a Booking

A booking is defined as a single, discrete transaction identifier generated by the platform that connects one customer (or customer group) with one instructor.

A group lesson (e.g., 4 participants) counts as one (1) booking

A multi-day course booked as a package counts as one (1) booking

Completion Criteria

A booking is considered completed and valid if all of the following conditions are met:

The scheduled lesson time has elapsed

No cancellation by either party occurred

Customer no-shows are counted as completed

The platform has successfully collected the full gross payment

Exclusions

The following do not count as bookings:

Refunded transactions

Chargebacks

Free or promotional bookings (Gross Merchandise Value = €0)

Equipment rentals

Lift pass sales

Merchandise sales

Inclusions

Alpine skiing

Snowboarding

Cross-country skiing

Off-piste guiding, provided it is sold under the instructional category

VERIFICATION AND TIMEFRAME

Verification method:

Audited internal reporting dashboardMeasurement period:

Platform launch date through April 30, 2027 (23:59 CET)Fiscal reference:

Fiscal year ending 2027