Which vanguard ETF will do the best over 10 years (starting 2024)?

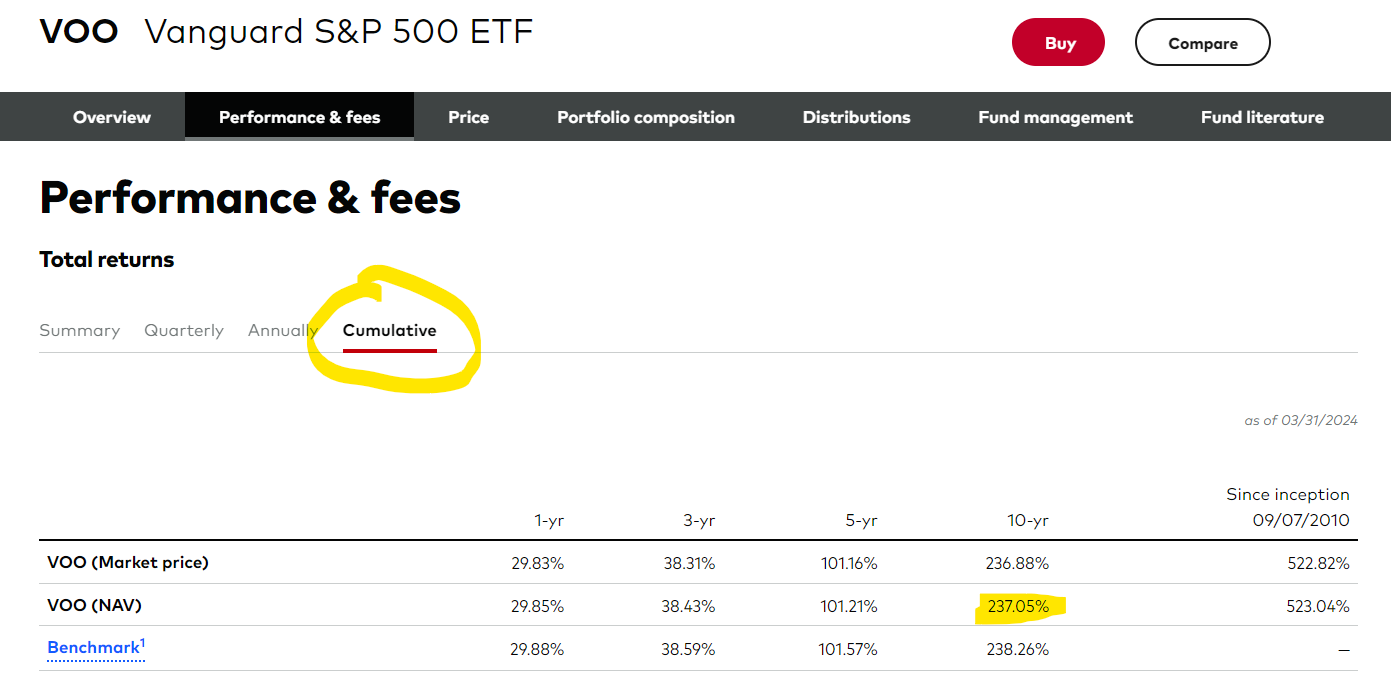

I will resolve based off the cumulative 10-yr NAV returns as of 4/30/2034:

eg:

More info:

https://investor.vanguard.com/investment-products/etfs/profile/vfmf

https://investor.vanguard.com/investment-products/etfs/profile/voo

https://investor.vanguard.com/investment-products/etfs/profile/vt

https://investor.vanguard.com/investment-products/etfs/profile/vea

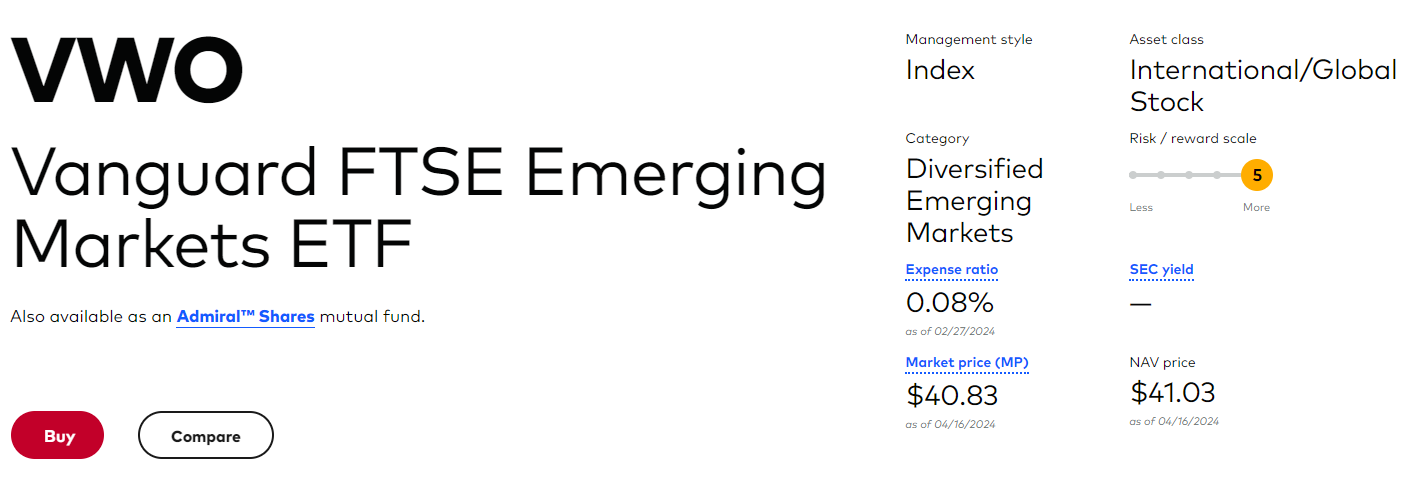

https://investor.vanguard.com/investment-products/etfs/profile/vwo

https://investor.vanguard.com/investment-products/etfs/profile/mgc

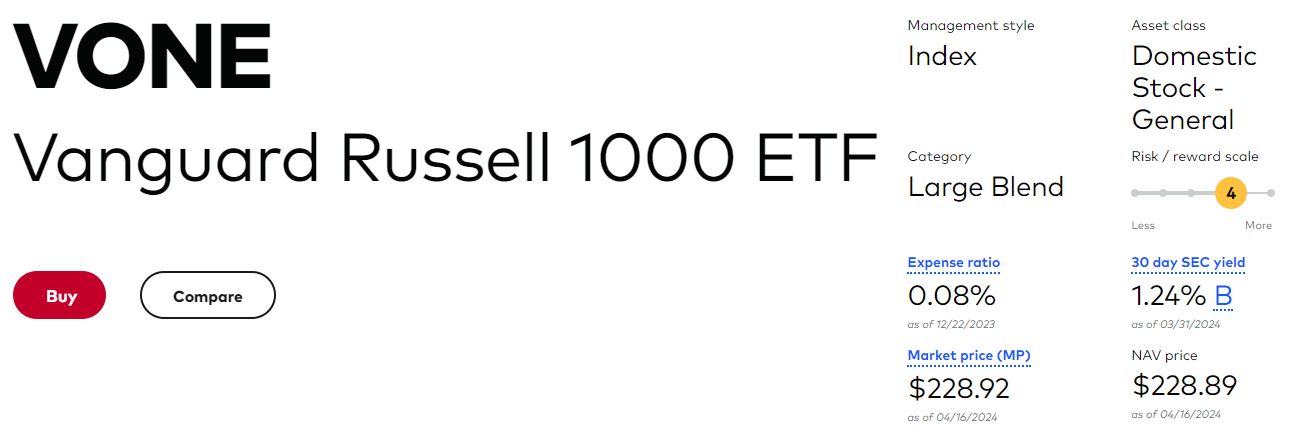

https://investor.vanguard.com/investment-products/etfs/profile/vone

People are also trading

This came up again on my feed, so, to echo @MichaelDickens's point, I think this is a serious contender for "most misleading title on Manifold" (given the current title: "Which ETF should I buy?").

No one is going to be able to share an insight about the expected value of returns of any of these ETFs that can't be observed by looking at the public markets.

The expense ratios don't differ enough to matter (among the real contenders)

Therefore, "what is the % that each ETF wins" either favors (a) the less diversified or (b) the ETFs that have already gone up the most (after April 2024), which are, respectively, a negative and neutral factor for what ETF you should actually choose for your portfolio if you are reading this question.

If the question was instead titled "which of these indices will go up the most", that would be one thing, but a question that purports to be about investment advice and operationalizes that as a mix of negative advice and neutral-to-advice past results (without clarifying the dates in the title) is just bait for people to bet on misinterpretations of the plain-English wording of the title.

@rossry worst title is a big claim!

Definitely not a good title though.

I'll change it, if anyone has good ideas on criteria that would actually address the question of "which ETF is best" I would be keen.

It should be virtually impossible for VT to win because VT is essentially a weighted average of VONE (or VOO) + VEA + VWO, so at least one of those ETFs should outperform VT regardless of what happens. By a different interpretation of "which ETF should I buy?", I'd say VT is the best one to buy for that exact reason.

@TrickyDuck I would agree. 3% of stocks account for all the growth in the s&p 500 over the past few years.