Currently, the formula is:

Fees = (shares) * prob * (1 - prob) * 0.07

If it gets changed in any way before July, this market resolves YES.

If I made the same kind of bet on the same market before August, with the same amt of subsidy and all that, and fees changed, the market resolves YES. If fees are removed, resolves YES.

however, if a new currency is added, named spice or anything else, that follows the same formula for fees but doesn't apply to mana, i won't consider that a different formula for the purpose of this question. If you think of extra edge cases, please bring them up! :p

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ176 | |

| 2 | Ṁ41 | |

| 3 | Ṁ30 | |

| 4 | Ṁ15 | |

| 5 | Ṁ15 |

People are also trading

@Bayesian seems clear to me, but just to confirm, the fact that now creators get 100% of fees until the first 1000M is irrelevant to the formula for fees, right? (because the formula in the description is still the same).

(also @ the discussion below, not sure if this conflicts anything, but at least the reason my intuition was off for a bit on fees is that this formula isn't about what gets paid after you tally up your purchase—rather the fee basically determines a "per share price" that gets added onto the market probability for the price of each share that you purchase. maybe that's what people were saying, but i was computing it a bit wrong originally)

@JamesBakerc884 shares don't cost 1M, they cost prob/100 mana for YES, and 1-that for NO. So if you're at 50% and you buy 1000M worth of shares, that's 2000 shares x 0.5 x 0.5 x 0.07 = 35M. So 3.5% of the 1000M spent. If you think I'm getting it wrong lmk though, I'm not 100% sure

@Bayesian Oh thank you for that correction, I got that part wrong.

shares*prob is the basic cost, then, and (1 - prob) is the "increasing the more unlikely" part... but that's only true if you're betting YES.

Does "unlikely" (in your understanding, and in your formula) flip sign when one is betting NO?

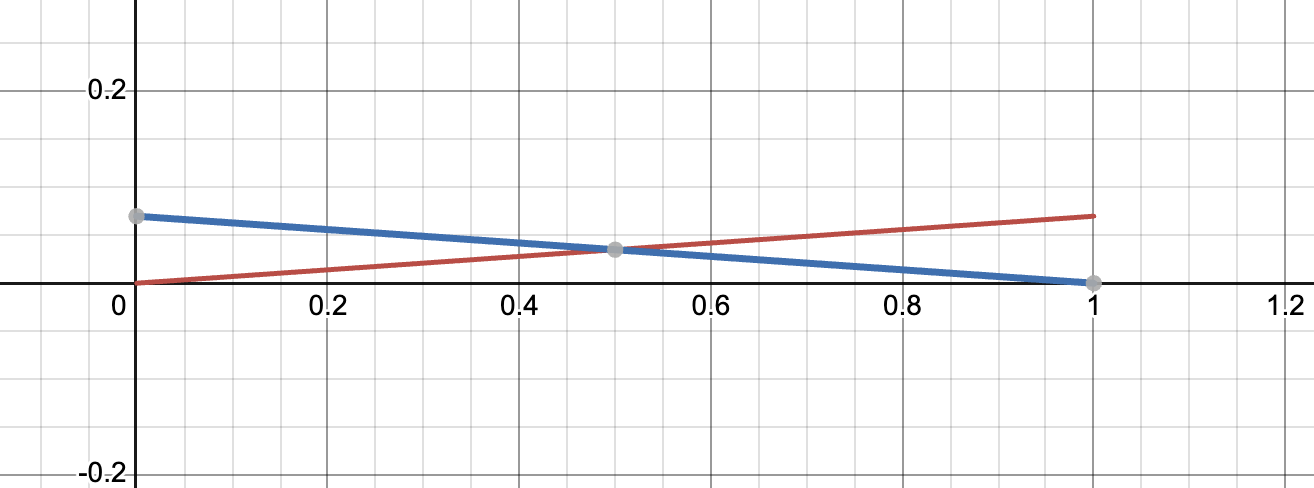

Up to a rough approximation (ignoring slippage), it's basically a linear function that is flipped between YES and NO:

the red line is YES, blue line is NO, x axis is the market probability, and the y axis is the percentage (0 to 1) you pay in fees per mana spent.

So if the market is at 1%, you pay almost 7% in YES fees (1% less than that i believe), and basically 0.07% in NO fees. If the market is at 50%, you pay 3.5% in YES fees, 3.5% in NO fees. If the market's at 99%, you pay close to 7% in YES fees, and 0.07% in NO fees. The shares x prob x (1-prob) part makes it so shares either cancels out with prob, or with 1-prob, depending on whether you're buying YES or NO shares

@Bayesian Cool so I hear you saying that your formula covers both cases already because you're using a "prob" that is "probability your bet pays off" versus raw market probability.

I think everything is clear for me, thanks for your patience!

@JamesBakerc884 Since the formula has (prob) * (1 - prob), it doesn't matter whether you take the raw market probability or the probability your bets pay off.