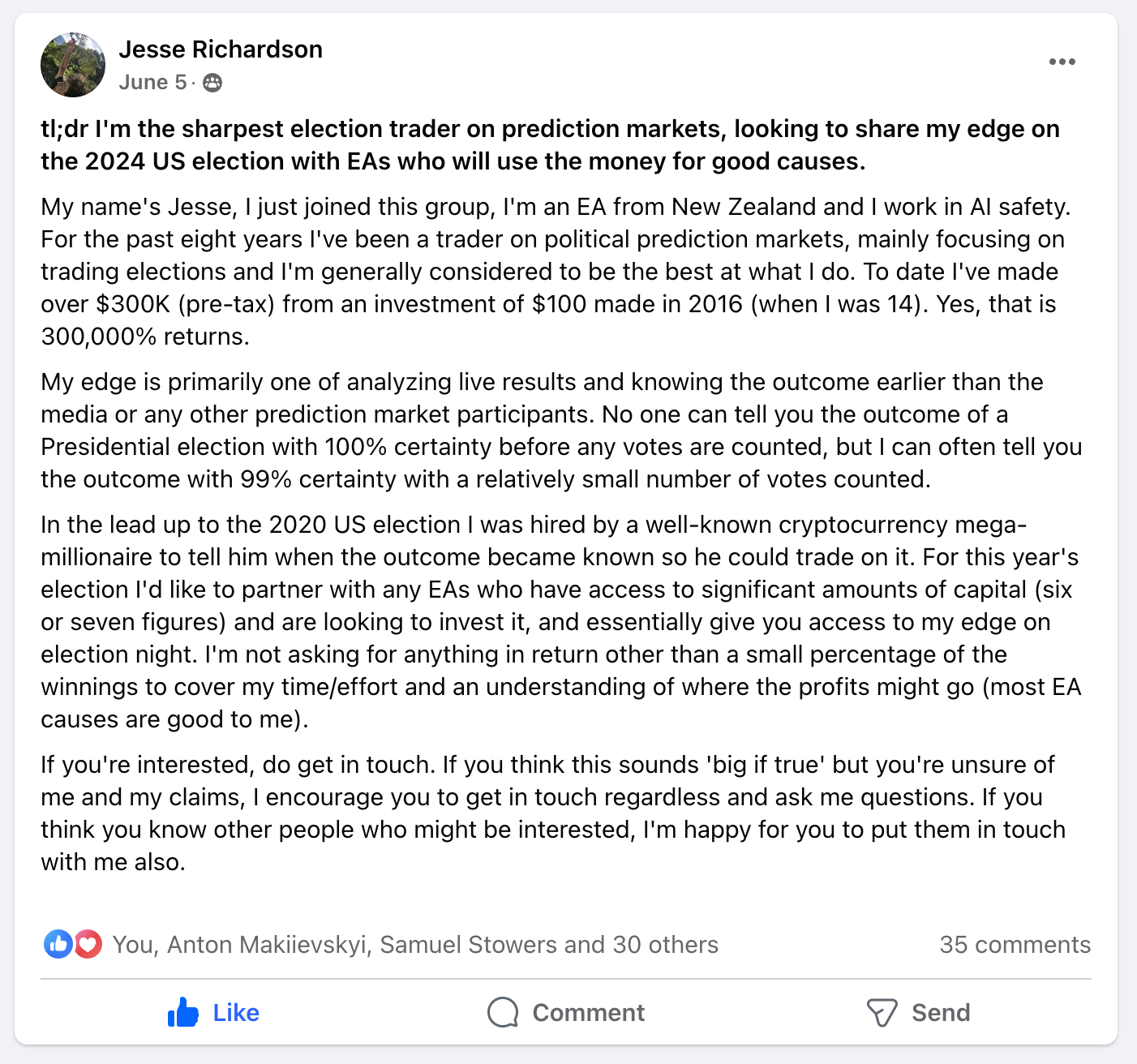

Jesse Richardson is a highly-accomplished election trader. For this 2024 election, he's been soliciting EA-aligned investors to increase his total bankroll:

I've spoken with Jesse on the phone; Marcus Abramovitch and Peter Wildeford also vouched for his skills. I decided to put in $150k via Manifund into this; profits are split 50/25/25 between Jesse, my regrantor budget, and Manifund treasury; losses are owned by me, coming out of my regrantor budget first and then my personal finances (aka I would personally donate to Manifund to make up the loss).

Will I regret this, ~1 week after the election? Some reasons I might:

If the investment ends up losing >$50k

If I'm convinced that doing this was very bad for Manifund optics

If I'm convinced that this was very -EV in expectation somehow

(nb I usually don't regret things I do, but eg I once got scammed out of $2k on a fake craigslist rental and regret that)

See also:

Jesse's still looking for more EA-aligned investors, so if you're interested reach out to me and I can connect you.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ4,101 | |

| 2 | Ṁ1,211 | |

| 3 | Ṁ336 | |

| 4 | Ṁ277 | |

| 5 | Ṁ164 |

People are also trading

We've withdrawn our initial $300k already, and are waiting on a projected ~$150k in gains before fees to Jesse (~$75k after fees), not to mention the gains that we've facilitated for Ross and Eric -- all of which will end up going to charity. Feeling pretty great about participating here; thanks all for your thoughts and feedback!

@FergusArgyll preliminary report is that Jesse was +15% over the course of yesterday! We'll see how the final tallies shake out; in the meantime, closing this market to further trading

@AndrewMcKnight So far Jesse's been doing quite well -- marked-to-market, my $150k is currently worth $191k or a +27% return. (of course, come election night there will probably be much more variance, hopefully in the upwards direction)

@Austin I just committed another $150k from Manifund (for a total of $300k invested), after hearing back from the SFF 2024 grant process, considering Jesse's performance so far, and seeing further demand for investing in Jesse's fund. The market resolution remains unchanged (scoped to my original investment).

Noting for the record that two folks @rossry and @EricNeyman have chosen to personally donate to Manifund and participate with their charity balance, bringing our total investment to $250k.

(Market resolution criteria is unchanged; market still resolves based on my initial $150k investment and resolves according to my discretion)

I am somewhat sceptical. According to Jesse’s post, he trades during periods of high volatility by being quicker and more precise. Typically, when volatility is expected to spike, market liquidity drops significantly, limiting trades to just a few thousand dollars. However, it’s very likely that Polymarket will heavily subsidize the election market on election day, making it possible to trade with larger amounts of money this time. (Trading with over 100k still seems excessive.) Also, high volatility tends to attract only the most skilled traders (with strong models), so Jesse would essentially be competing against the best Polymarket traders. Currently, during periods of low volatility, Polymarket functions as a positive-sum game thanks to the reward system, making it easier to earn profits, so Jesse’s trading returns in those intervals have no predictive power.

If someone shares Jesse’s Polymarket address, I’d be happy to run some analysis! :D

@Ayers mm prior to me investing, he started this election cycle with $200k and made it up to $290k in 6 weeks. I think this was during the chaos around Biden dropping out so not necessarily predictive, but also not totally unpredictive

Low information take without understanding much of the details: The 50/50 profit split seems like a lot. Unless you expect Jesse to make very +EV bets or very low-risk bets, I think this makes the proposition -EV on your end. (Although, I guess if Jesse is as good as claimed, that expectation could be accurate)

@Nightsquared I expect Jesse be very good at managing risk, based on his historical performance, what he's told me and what I've seen of his positions. (he's not like, just putting it all down on Trump)

@nikki appreciate the feedback! Again, losses to Manifund are insured by my own money here, and I fundamentally don't see this as very different than other kinds of treasury management that Manifund or other nonprofits do. (nonprofits are indeed allowed to earn money in for-profit ventures - eg think of college endowments that invest in index funds or stocks)

If I'm convinced that this was very -EV in expectation somehow

Will you make this conclusion based on anything but the eventual profit total? Like I don't imagine Jesse will be keeping you posted about exactly what he's doing. So will there be anything that enters this calculus besides (a) you observing election night yourself, & (b) Jesse telling you how much money they made/lost. Or is this more of an option for someone else convincing you that this was -EV (and you don't expect that on your own you'd believe that, no matter what happens).

@Ziddletwix More of an option (or bounty) for somebody else to convince me. I imagine most worlds in which the investment returns ~0% or is positive, I just won't be very bothered to investigate Jesse's specific trades too much. (I guess, if the investment 10xs or something I would want to figure out how that actually happened. FWIW, Jesse is sending us ~biweekly updates on what he's been up to.)