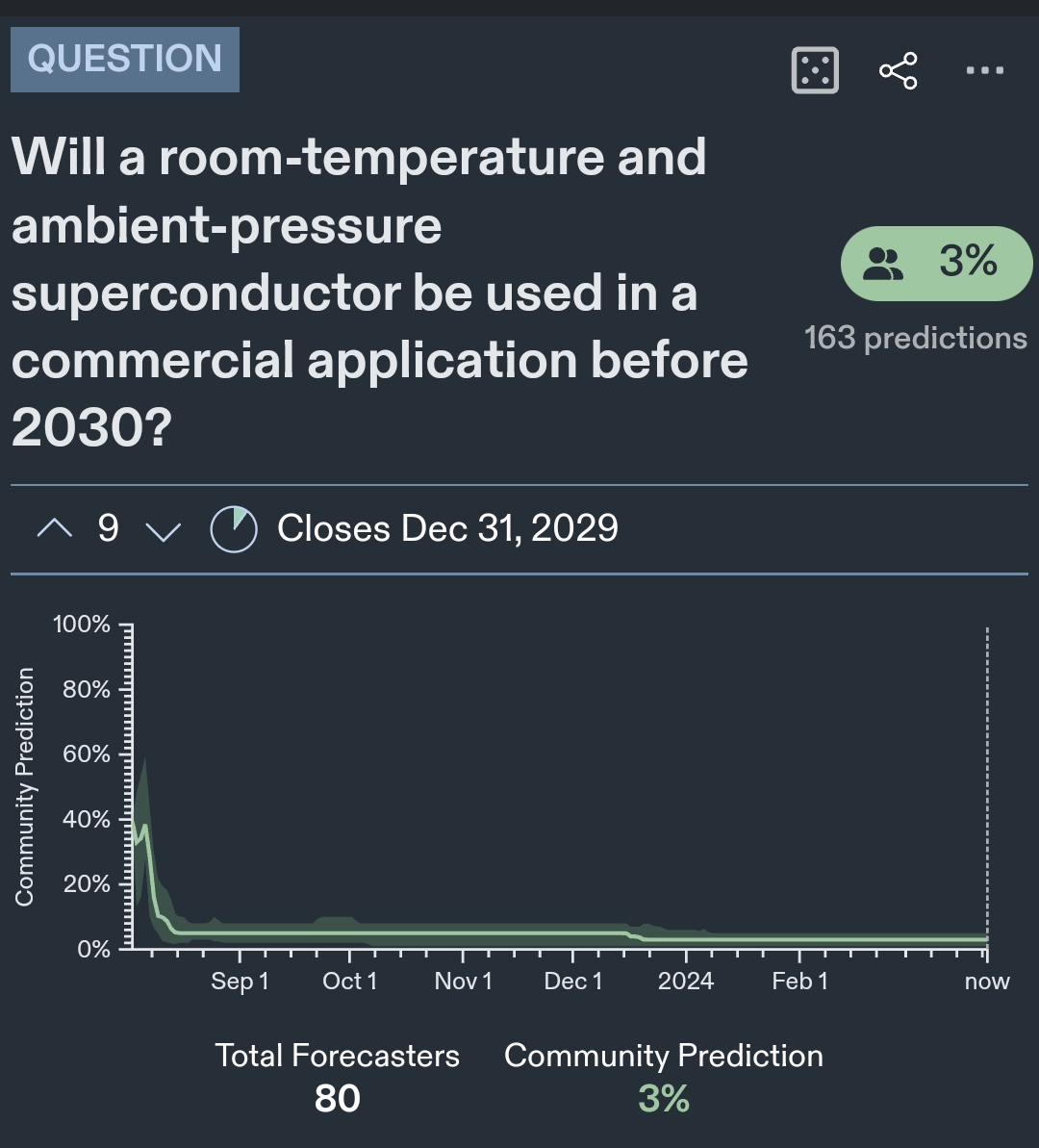

To qualify, the material must act as a superconductor above 0C.

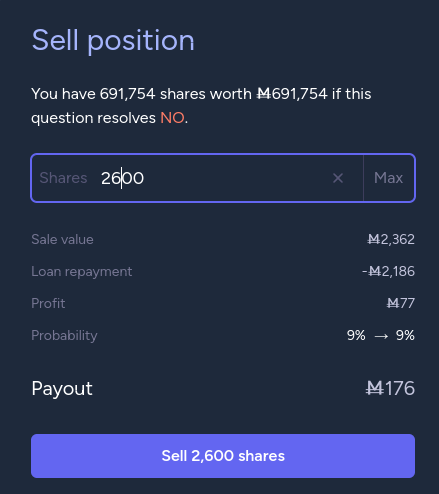

Not that anybody cares, but it's interesting how not worth it it for me to sell out of this market at the current price (not that I could).

The current value of my shares is Ṁ627k, and I have a loan for Ṁ584k. That means only Ṁ43k of my mana is locked up here.

Yet when it resolves NO, it pays out Ṁ692k. That's a 16× return on the Ṁ43k I could hypothetically get by selling, or 63% per year, 4.2% per month. Not bad! It'll be even better in two weeks after about a third more of that 43k is loaned back to me before loans cease.

Sure, Manifold may not be around by the time this closes, but other than that concern that seems like an OK rate of return. Loans really did incentivise betting in long-term markets.

Edit: as pointed out below, this is totally wrong lol, I forgot to account for...having to pay back the loan.

@chrisjbillington the zero sum nature of trading on manifold is the problem here. For every mana you sank in and got loaned back someone sank mana on yes. When it resolves no, you will be able to afford to pay back your loans but the yes holders won't.

@Odoacre Yes, that is a problem. Limiting loans based on probability-of-ruin would reduce the bankruptcies though - in which case, I'd have fewer counterparties and wouldn't have gotten so leveraged either. Seemed like that was the solution, rather than getting rid of loans entirely. Interested to see what they've come up with for incentivising long-term betting - they've hinted they have other ideas.

There are upsides to getting rid of loans too - the fact that repayment was linked to selling shares in specific markets was always a bit distorsionary, e.g. incentivising you to not sell bad positions because you'd trigger early loan repayment. Maybe you could do loans the traditional way, where someone just loans you mana with a repayment schedule - not linked to any one market. I guess we can keep doing that with p2p loans - nonzero interest will make it very different though.

@chrisjbillington technically not a 16x return cause you've got to pay back the loan.

692−584 = 108. 108 / 43 is 2.5 x return.

Absolutely spot on about the ruin probability though.

[deleted, not sure I'm making sense]

@chrisjbillington maybe I'm missing something.

If you sold now you get a net of 43.

If you wait until resolution you get a net of 108. Or is 692 the net?

@chrisjbillington At some point it will always make sense to sell shares when the price is sufficiently far from your beliefs in the appropriate direction. You do have to consider how much mana is locked up and its ROI, but that's a secondary concern, the primary concern is simply whether a marginal bet on yes or no is profitable.

Additionally, it often makes sense to sell shares from a Kelly perspective - even if the ROI looks good to hold, it may still be a bad idea from a risk/return perspective.

@jack yes, though it depends whether I'm mana constrained (or expect to be), which I usually am and do. If I am mana constrained, then I'm looking at the opportunity cost of betting, and not just profitability, so the threshold of profitability below which it doesn't make sense to trade is higher.

You're right about Kelly, though it comes up pretty rarely for me at least.

@Daniel_MC I think you're right, deleted my previous comment, but will think about it to make sure - maybe it would make sense to try to sell out of this market after all.

@MartinRandall Lol this is so not worth it. Looks like I should just keep the leveraged position. I'll leave the 7% exit order up (that was market price when I made it!), but guess I don't really expect anyone to take it, and it seems barely worth me selling even at that price.

@Joshua 434 people bettering yes, 146 people betting no. Average yes bet is higher. I'm not talking about Metaculus, this market would be totally different if it wasn't for Chris

@SimoneRomeo That's not really how prediction markets work, only looking at how many people are betting yes or no does not give you the whole picture of what's going on. For example, imagine a user betting down to 30% in a coin toss market. Another user may come along, see value in betting up to 50%, make that bet and leave. Then the first user bets the market down to 30% again, another user bets it up to 50% and so on until the market gets to N people betting YES and a single user betting no. What's important is that the market has stabilized at around 50%, not how many people are in one side or the other. A YES bettor would buy NO if the market went over 50%, because what matters is the percentage. If you think this market is too low at 7% then buy yes, that's all there is to this.

@SimoneRomeo How would you know that nobody else would bet it down again to the same level if Chris hadn't bought as much?

(I.e. I know that I would buy far more no myself. I have to assume that's true for others as well.)

@TenShino yeah, this is how it would work in a fair world where everyone has the same amount of money to bet on what they prefer. I don't have any available mana to bet here, let alone to move the percentage.

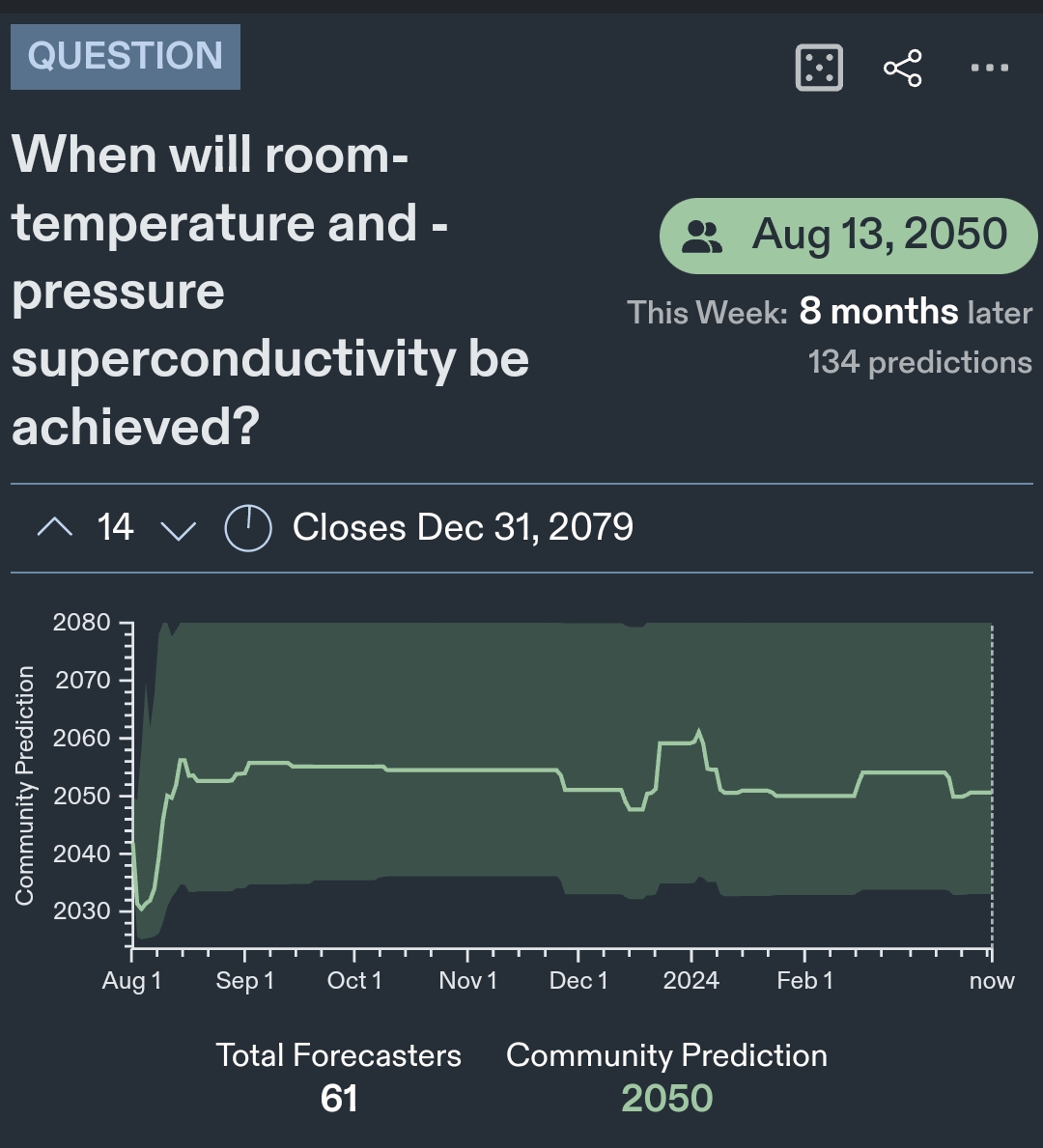

@bdf “Superconductors are getting better fast“.

Superconductors have been seriously investigated since 80-110 years, with funding in the millions/y since ~40-50 years. (Rough estimates of investments are on the OoM of 100m-1B/y since the 80s.

This market closes in 6 years.

These are the results of those investments.

Not bad, obviously. Oxides are a big deal!

But again, this market closes in 6 years. Room temperature is 300K!